China Injection Mold

ICOMold by Fathom has injection molding facilities in the United States and China. This gives ICOMold a worldwide reach and presents customers yet another way to save money during the manufacturing process. ICOMold is able to leverage our manufacturing capabilities on a global scale to keep cost low while maximizing turnaround and production times.

ICOMold’s partner injection molding facilities in China operate at the same high standard as our stateside facilities. ICOMold only uses high-quality, pre-hardened steel in every single mold that we make – whether the injection molding is done in China or in the United States.

How Much Does It Cost To Make A Mold in China?

Injection molding in China can save customers 20-40%. Turn around times can even be faster than stateside service. But not every injection molding company in China is the same. Customers must find a company who can deliver on several key components in order to reap the benefits of lowered production costs and fast turnaround times. ICOMold by Fathom offers great communication, a team of experts with decades of experience, and intellectual property security. ICOMold can ensure all of those aspects.

ICOMold’s China Injection Molding and Manufacturing Advantages

Easy Communication

ICOMold is a U.S.-based injection-molding company with a high-quality, low-cost manufacturing partner facility in China. There are many “China Direct” injection-molding companies, however ICOMold has one distinct advantage – no language barrier. English-speaking customers will work with an English-speaking project manager who will provide engineering support, customer service, and handle the injection-molding project from start to finish in China.

At Your Convenience

ICOMold’s office is located in Hartland, Wisconsin so there is no need to worry about the time difference with an offshore company. ICOMold is available during normal business hours — whether it is just for a quick email response or an in-depth discussion over the phone, we are ready to help keep your injection-molding project on schedule.

Decades of Experience

ICOMold by Fathom has been in the plastic injection molding business since 2003 and is run by experts who have decade’s worth of combined experience. ICOMold understands the challenges involved in trying to work directly with injection molding companies in China. Our hybrid business model is built to solve those issues. At ICOMold, our partner China injection mold making team and staff operate under the same strict standards as the facilities stateside. They are able to take even the most challenging part from design to production.

Save Money with China Injection Molding

ICOMold is based in the United States and stands behind our manufacturing capabilities in China. Customers do not need to worry about an offshore company taking the money and returning an inferior product. ICOMold partners with a dedicated injection molding plant in Shenzhen, China. This allows us to benefit from lower manufacturing costs while at the same time controlling the injection mold manufacturing, quality assurance, and post-production processes. These savings are then passed directly to our customers.

All of ICOMold’s China Injection Mold Projects are Protected Under US Law

Injection molding in China with ICOMold is safe and effective. There have been more than a few accounts of unscrupulous foreign companies violating the intellectual property (IP) and legal rights of customers. ICOMold is a U.S.-based company and maintains its customers’ confidential information in accordance with United States law. We are diligently committed to protecting your IP. Whether it’s personal or company information, CAD files, quotes or orders, we keep our customers’ proprietary information confidential. To learn more about intellectual property protection, please visit our Terms and Conditions page.

ICOMold Supports American Manufacturing

From time to time, we talk to customers who only want to do business with plastic injection molding companies that operate solely in the United States. We support and respect that stance. However, those customers will typically pay a premium when it comes to the overall project cost. ICOMold by Fathom is able to provide lower pricing for injection molds and plastic parts because of our lower cost manufacturing structure in China. ICOMold can also provide a solution for customers who want the manufacturing done in the United States rather than in China. Our mold-making partner in China will produce an export mold. Export molds are shipped to the customer who can use them in their own injection molding facility or with the injection molding facility of their choice.

The Best of Both Worlds

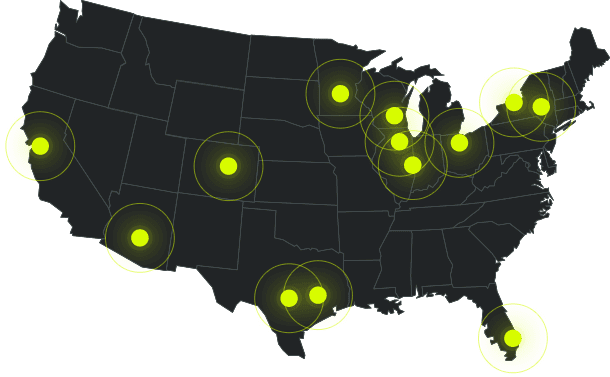

ICOMold has been very successful with this Best of Both Worlds approach. We are able to serve customers who are seeking to save time and money on custom plastic injection molding by utilizing our partner facilities in China. See our customer testimonials for more information. This dual business model provides lower costs, higher quality, and none of the headaches from dealing directly with an offshore manufacturer. Check out the instant quote system to see how much money you can save on your next custom injection-molding project.

Plastic Manufacturing Quality You Can Trust

As a leading manufacturer of plastic injection molds, it is our duty to ensure the products we produce are of the highest quality at a price our customers can afford. Our customers come to us from a wide variety of industries. ICOMold has the experience and track record to provide the level of detail that each customer will require.

ICOMold Has Completed Projects for These Sector and More:

- Pharmaceuticals

- Telecommunications

- Industrial

- Transportation

- Consumer Electronics

- Consumer Products

- Appliances

- Sporting

- Energy

Visit the plastic injection molding and CNC machining case studies page to see how ICOMold by Fathom has helped customers complete their projects.